PRESS RELEASE

Global Commercial Non-Life Insurance: Size, Segmentation and Forecast

Download the PDF version of this press release here.

London, 16 January 2020 – According to a new series of studies completed by Finaccord, the world’s commercial non-life (property and casualty) insurance market – including insurance bought by corporate, business, public sector and not-for-profit customers but excluding premiums paid to captive underwriters – was worth around USD 812 billion in 2018 in terms of gross written premiums, and is on track to reach a value of around USD 978 billion by 2022, equivalent to a nominal compound annual growth rate of 4.8%.

By broad product category, it segmented in 2018 between around USD 224 billion due to commercial liability insurance, USD 46 billion to commercial MAT insurance, USD 205 billion to commercial motor insurance, USD 257 billion to commercial property insurance and USD 78 billion to other types of commercial insurance (e.g. legal protection, surety, trade credit).

Looking in more detail at specific product classes within those categories, particularly valuable market segments included workers’ compensation insurance (at around USD 88 billion due mainly to its vast size in the US), goods-in-transit insurance (USD 33 billion) and professional indemnity insurance (USD 21 billion, excluding medical malpractice cover).

Stated Francisco Leitão, a Consultant at Finaccord: "By far the most rapidly growing product class in recent years has been cyber insurance. Both stand-alone premiums and cover packaged with other policy types are understood to have surged in value and the global outlook for this product class is also very favourable as many types of organisation are keen to protect themselves from cyber risks."

As well as segmenting the value of the global commercial lines market by product category and class, Finaccord’s new series also breaks it down both by size of insured entity and by customer activity. By size of insured entity, the worldwide split of premiums is between around USD 210 billion to micro entities, USD 329 billion to small and medium-sized entities and USD 272 billion to large and very large entities. The market value among large and very large entities is smaller than might be expected due to their extensive use of captive and self-insurance arrangements.

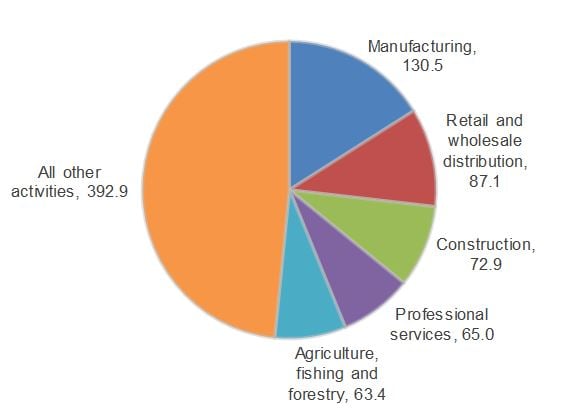

As for the breakdown by customer activity, Finaccord’s analysis indicates that commercial lines insurance acquired by manufacturing enterprises was the largest segment in 2018, with premiums worth around USD 130 billion worldwide, followed by retail and wholesale distribution at USD 87 billion.

"With global compound annual growth rates of around 6% in each case, premiums for commercial lines cover bought by enterprises in the construction and not-for-profit sectors are forecast to increase most rapidly through to 2022”, concludes Francisco Leitão.

--- ENDS ---

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services that is part of Aon Global Operations (Singapore Branch), a part of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances, as well as commercial lines insurance.

Finaccord’s series of reports about the size, segmentation and forecast for commercial non-life insurance markets covers 15 countries:

Australia,

Belgium,

Brazil,

Canada,

China,

France,

Germany,

India,

Italy,

the Netherlands,

South Africa,

Spain,

Switzerland, the

UK and the

US. Collectively accounting for close to three quarters of worldwide commercial lines premiums, the data in these studies allows Finaccord to extrapolate the data to the global analysis contained in this press release.

Notably, the series represents the first ever published segmentation of major commercial lines insurance markets not only by product category and class but also by customer size and activity.

By product class and category, data is available across the following segments: commercial liability insurance, breaking down between D&O, environmental liability, medical malpractice, professional indemnity and other liability cover; commercial MAT insurance, breaking down between aviation, goods-in-transit and marine cover; commercial motor insurance; commercial property insurance; and other commercial insurance, breaking down between cyber, kidnap and ransom, legal protection, political risk, surety, trade credit, workers' compensation and other cover.

Meanwhile, by customer activity, data is available across the following segments: agriculture, fishing and forestry; construction; energy and power; financial institutions; healthcare and life sciences; hospitality; manufacturing; mining and minerals; not-for-profit; professional services; public administration and education; real estate; retail and wholesale distribution; technology and media; transportation (air) and aerospace; transportation (marine); transportation (road and rail); and other services.

Global commercial non-life (P&C) insurance premiums, segmented by the largest five customer activities on this measure and all other customer activities combined, 2018

Note – values are USD billion

Source: Finaccord report series about commercial non-life insurance worldwide