PRESS RELEASE

Lending Metrics: Consumer Approaches to Credit Products and Distribution in Selected Global Markets

Download the PDF version of this press release here.

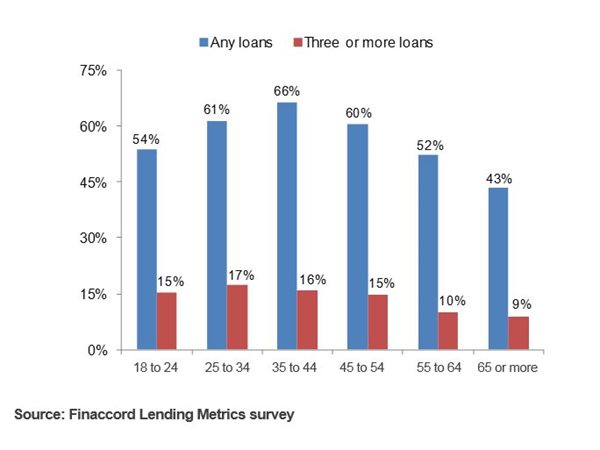

London, 13 October 2016 – Across eight countries investigated by Finaccord, 39 is the age at which individuals are most likely to need to borrow money albeit 31 is the one at which they are most probably juggling multiple loans. These are headline findings from new Finaccord’s new Lending Metrics consumer research series covering Australia, Canada, France, Germany, Italy, Spain, the UK and the US, which investigates how the approaches of individuals to credit products and distribution are changing as the consumer lending market itself is subject to radical, technology-led change.

“As an average across the eight countries researched, over two thirds of individuals aged 39 are paying off at least one loan, which is very often a mortgage”, observed Claire Michaud, Consultant at Finaccord. “However, 31 might be considered the peak age for borrowing as close to one in five individuals are servicing three or more loans at that age – potentially including student loans, vehicle finance contracts and other types of loan, as well as mortgages – although this ratio then declines gradually up to the age of 55 after which individuals are a lot less likely to need to borrow from multiple sources.”

The research also established that there are some quite substantial differences between the types of loan used by individuals across the eight countries. For example, overdrafts are particularly popular in France and Germany and retailer point-of-sale finance (i.e. finance taken out to buy things from shops and other merchants) in Italy and Spain. Meanwhile, consumers in Canada and the US are most likely to have a mortgage and those in Australia, albeit by a narrow margin, show the greatest propensity to take out both guarantor and payday loans as well as loans secured on possessions other than property (e.g. using jewellery or electrical goods). Also, the research indicates a developing market for loans taken out through P2P or marketplace lending platforms in all eight countries although this remains small when compared to the markets for other types of loan.

Continued Claire Michaud: “A further significant finding, especially for the emerging generation of digital lending entities with a FinTech background, is that online loans now account for a significant proportion of total lending in all eight countries. In fact, well over a half of all consumer loans are now taken out online in both Australia and the UK albeit the average for the other six countries combined is some way behind at just over 30%. Consequently, use of aggregators to take out loans is also highest in Australia and the UK and borrowers there are also more likely to make use of brokers rather than borrowing directly from the ultimate lending institutions.”

Also of interest are the reasons given for needing to borrow. Apart from buying a home or a vehicle, the motives mentioned most regularly by respondents to the research across the eight countries are to buy furniture, to buy an electrical product or appliance, to pay for general day-to-day living expenses and to finance holidays or other travel. However, needing funds for a start-up business is a reason given in less than 1% of cases.

Concluded Claire Michaud: “The consumer lending markets of all eight countries researched, plus many others around the world, are being revolutionised by the rapid development of digital lending technologies, the introduction of disruptive new loan concepts and the increasing usage of online distribution. The evidence of our research is that many borrowers are welcoming this change to the status quo.”

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services. It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

Lending Metrics is a series of reports that provides detailed and timely insights into the rapidly evolving markets for consumer lending in eight countries, namely Australia, Canada, France, Germany, Italy, Spain, the UK and the US.

Based on a survey of over 9,000 consumers, the research specifies the percentage of adults in each country making use of ten different types of credit product plus how holdings of each loan type split by gender, age group, annual household income, employment status and presence of dependents. Furthermore, the series delivers unique data illustrating both consumer propensity to take out loans online and to make use of lending product aggregators (comparison sites) when doing so. Loan types in scope including the following:

mortgages; other loans secured on property; loans secured on possessions (e.g. jewellery or electrical products); vehicle loans / leasing contracts; retailer loans / finance contracts; overdrafts; payday loans; guarantor loans (i.e. loans guaranteed by relatives or friends); credit cards; and other (unsecured) loans (including those taken out via P2P / marketplace lending platforms).

Sample graphic

Average percentage of respondents with any loan / three or more loans across eight selected global markets, segmented by age group, 2014 to 2016