PRESS RELEASE

COVID-19 has accelerated and reinforced the global shift towards buying insurance online

Download the PDF version of this press release here.

London, 1 February 2022 –

How has COVID-19 affected how people buy insurance? The pandemic has clearly brought seismic changes throughout societies across the world, and the insurance industry has not been an exception. Finaccord has released a dedicated consumer study across ten key markets, revealing in detail how insurance buying has changed.

Key findings include:

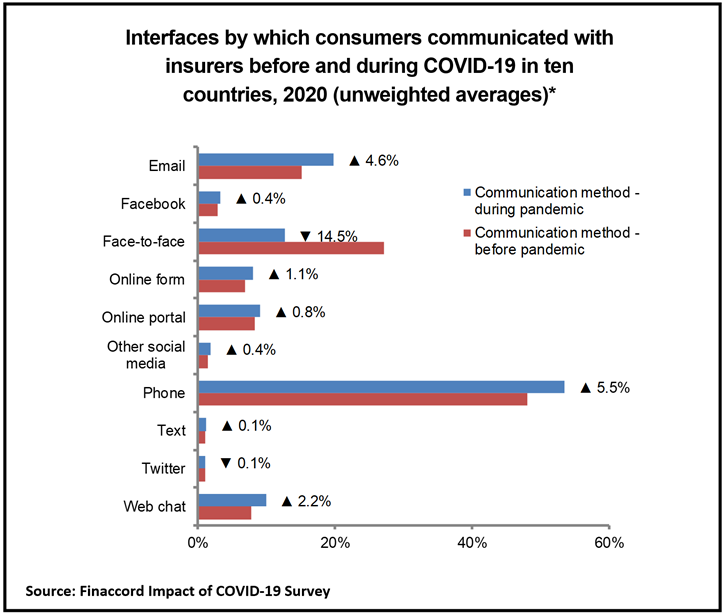

- As might be expected, in 2020 online and telephone interfaces took over from face-to-face communication with insurers. These changes varied substantially between countries, however, depending on both pre-pandemic interface use and the severity of lockdowns. In Australia, for example, face-to-face contact fell from 11% of all communications with insurers to 7%, while in Brazil it plummeted from 30% to 5%.

- People expect to continue buying insurance online. In six of the ten countries, more than half of respondents expected to buy online in future more often than before 2020, rising as high as three quarters of Chinese respondents. Even in France, where respondents were least enthusiastic about buying online, the equivalent proportion was over a quarter.

- At the same time, offline sales remain important: in seven countries, over 40% of respondents had never bought insurance online and did not expect to do so more after 2020.

- The pandemic has also spurred the use of technology within insurance policies. Lockdowns generated a major shift towards telematics insurance among younger drivers: on average 12% of drivers in the 18-34 age range switched to a telematics policy.

- Despite the accelerated shift to digital communications, the potential for market disruption by major tech brands remains limited: most respondents were found to trust their insurers more than the tech brands. However, trust is closely linked to age: younger respondents were notably more likely to favour the tech brands. Levels of trust also vary hugely between countries.

- Insurers are particularly concerned with their reputation in the wake of COVID-19, as they have had difficulties offering cover, and as pandemic-related claims disputes have been widely reported. Finaccord’s survey offers reasons for optimism: looking at how respondents’ views of their insurer had changed since lockdowns began, the result in eight of the ten countries was net positive.

Finaccord’s survey results indicate that insurers will need to continue focusing on and improving their digital offerings. However, they also need to understand the nuances of each market and demographic segment, identifying where traditional channels remain important and where tech brands represent a potentially disruptive presence.

--- ENDS ---

Media contact: David Parry, +44 20 7086 0287,

[email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services that is part of Aon Global Operations SE Singapore Branch, a part of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances, as well as commercial lines insurance.

Finaccord’s series of reports detailing consumer attitudes and behaviour towards insurance in the context of the COVID-19 pandemic, titled

Impact of COVID-19 on Personal Lines Insurance: Consumer Attitudes and Behaviour in Selected Global Markets, covers ten countries: Australia, Brazil, Canada, China, France, Germany, Italy, Spain, the UK and the US.

To produce these reports, at least 1,000 respondents were surveyed in each of Australia, Canada, France, Germany, Italy, Spain and the UK, over 1,500 in Brazil and around 2,000 in each of China and the US. Respondents in each country are segmented by gender, age, occupation and income group.

Research covers four broad areas: the impact of lockdowns in 2020 on respondents’ daily lives, changes to the ways respondents communicated with insurers, changes to the frequency of online purchases and use of telematics, and consumer attitudes towards and trust in insurers and major online brands.

*

Note: China is excluded from the averages for Facebook and Twitter, since the survey for China referred to WeChat / QQ and Weibo instead.