PRESS RELEASE

Aggregation Metrics: Consumer Approaches to Online Insurance Comparison Sites in Global Markets

Download the PDF version of this press release here.

London, 6 October 2016 – New consumer research completed by Finaccord in the form of its Aggregation Metrics series covering Australia, Canada, France, Germany, Italy, Spain, the UK and the US demonstrates that online sales of car (auto) and home insurance, in general, and rates of usage of comparison sites, in particular, continue to vary greatly from country to country. For example, as an eight-country average, 46% of respondents to the survey switching their car insurance policy or buying one for the first time did so online albeit this peaked at 74% in the UK but was as low as 17% in Canada. Meanwhile, over 40% of the same constituency in the UK used an aggregator to take out car insurance but this figure fell to less than 5% in both Canada and the US.

“While many insurers sell online and there are long-established comparison sites in all eight territories, consumer behaviour differs substantially from country to country when it comes to buying car and home insurance”, commented Stefan Wagner, Consultant at Finaccord. “This is due to a number of factors including differences in switching rates between the various countries plus the strength of competing distribution channels in some of them, such as tied agents in all countries other than Australia and the UK, independent agents in Canada and the US, banks (for home insurance) in France, Italy and Spain, and direct sales by mutual insurers in France.”

Nevertheless, Finaccord’s research indicates that online sales as a distribution interface and comparison sites as a distribution channel are likely to be growing in most countries as they are more heavily used by new buyers and switchers than by the wider universe of all customers, including those renewing policies taken out in previous years. Moreover, their development may also be assisted if an increasing proportion of insurance buyers need to take out non-standard car or home insurance policies, or telematics-enabled car insurance in future as the research (perhaps surprisingly) indicates that customers with these types of cover are generally more likely both to buy online and to use a broader range of distribution channels than customers with standard products.

Continued Stefan Wagner: “On average, non-standard cover accounted for 18% of car insurance policies and 30% of home insurance policies across the eight countries. In the former case, ownership of multiple vehicles was the most common reason for requiring a non-standard policy while in the latter case a need for insurance covering contents with a higher-than-average value was the main cause. Meanwhile, the average penetration rate for telematics-enabled car insurance was a little under 8% which is indicative of its substantial potential for future growth, as is the fact that the equivalent figure for the most developed country, namely Italy, was more than 20%.”

Going forwards, Finaccord believes that online insurance comparison sites can expect to make progress in most countries albeit they may now have reached a peak in the mature UK market. However, key to the success of individual operators in this field will be the extent to which they can both drive rates of awareness within their target audience, which can be difficult due to the large marketing investment needed to achieve this aim, and convert potential customers browsing their sites into actual purchasers. Concluded Stefan Wagner: “Across the 64 comparison sites for which the survey measured these and other metrics, the UK’s Comparethemarket.com scored most highly in terms of its recognition rate, as 56% of respondents stated that they were very aware of it. Meanwhile, Spanish comparison sites recorded the best rate of converting visitors to buyers at 26%, comfortably ahead of the eight-country average of 20%.”

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services. It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

Aggregation Metrics is a series of reports offers new insights into the current development and future prospects of online insurance comparison sites in eight countries: Australia, Canada, France, Germany, Italy, Spain, the UK and the US. It examines consumer propensity to research and purchase any kind of insurance online plus the size of the available market for the key products of car (auto) and home insurance, as defined by new customers and switchers; it then analyses the distribution channels and interfaces used for acquiring these policies, highlighting both the share of aggregators, in particular, and the share of online sales, in general, including indicators for the speed at which these are growing.

Moreover, it investigates the extent to which online insurance buyers are using tablets or mobile phones for this purpose, as opposed to regular laptop or desktop computers, and establishes whether propensity to use aggregators is influenced by a range of variables including not only gender, age, annual household income and employment status but also type of cover held, differentiating between standard and non-standard policies and (for car / auto insurance only) between telematics-enabled policies and not telematics-enabled policies. In addition, it benchmarks the performance of eight of the leading insurance comparison sites in each country in terms of awareness levels, conversion rates and sales.

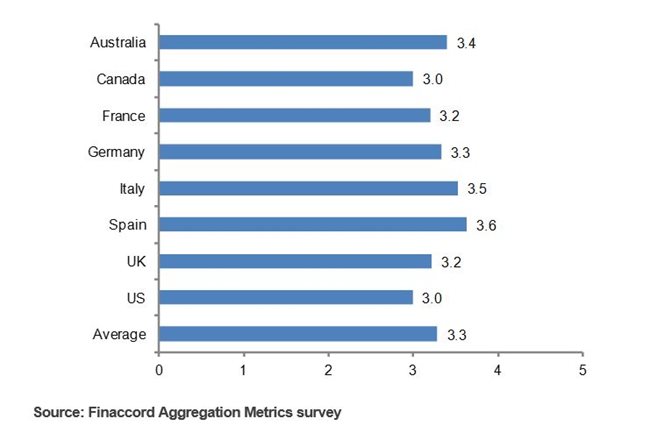

Sample graphic

Average number of sites used by respondents searching for insurance online, 2016