PRESS RELEASE

International Health Insurance for Expatriate, Students and Affluent Residents: A Worldwide Review

Download the PDF version of this press release here.

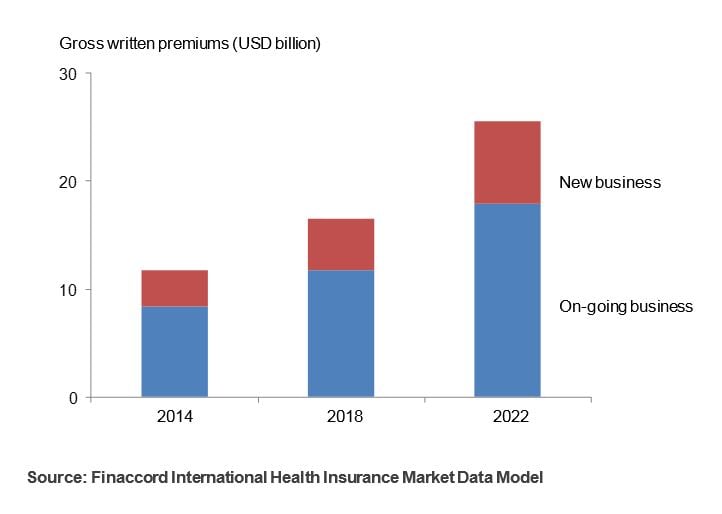

London, 27 March 2019 – According to new research published by Finaccord, the global market for international health insurance for expatriates, students and affluent residents was worth around USD 16.5 billion in gross written premiums in 2018 of which around USD 4.8 billion was due to new policies bought in 2018 itself. This total breaks down between around USD 12.4 billion to expatriates apart from students, around USD 3.3 billion to students and around USD 812.2 million to affluent residents with the latter segment increasing most rapidly of all.

Commented David Bowles, Consultant at Finaccord: “The worldwide market for international health insurance is both large and fast-growing. Its value has now exceeded that of travel insurance, which Finaccord estimates at around USD 14.7 billion in premiums for stand-alone cover in 2018. Although it constitutes a small segment within the global market for all types of health insurance which is valued at around USD 1.55 trillion for 2018, its compound annual growth rate of 9.0% between 2014 and 2018 is comfortably ahead of that for health insurance in general which is recorded at around 7.2% over the same period.”

Overall, there were around 97.4 million expatriates and students worldwide eligible for international health insurance in 2018 defined as those temporarily resident in a country other than their country of origin for a period of between three months and ten years. These are composed of five main potential customer types, namely individual workers (most numerous at 83.3 million), corporate and other transferees (including diplomats and employees of charities and NGOs), retired individuals and students plus ‘others’ (defined as non-employed spouses and children of customers in the other four categories).

“By region of origin, these eligible individuals are most commonly from countries in the Asia-Pacific region given that there was a total of around 47 million of them in 2018,” continued David Bowles. “Furthermore, as a destination region, countries in the Middle East attract the most such individuals albeit those going there are among the least likely to acquire international health insurance. Rather, insurance take-up rates are highest among expatriates and students heading to destination countries in Africa, Latin America and North America, with the high cost of healthcare in the latter region, especially the US, a particularly important factor in this respect. Overall, just over 10% of all individuals eligible to buy international health cover actually do so in practice.”

Looking ahead to 2022, Finaccord’s research suggests that the compound annual growth rate in the value of this market is likely to pick up to 11.5% which means that the market will be worth around USD 25.5 billion by that year in terms of premiums. However, this expansion will be due primarily to rising average policy prices and secondarily to growth in the number of expatriates and students eligible for international health insurance rather than to an increase in the take-up for this type of cover, which is expected to advance only modestly. Concluded David Bowles: “If underwriters and intermediaries of international health cover can find ways to improve the distribution of their products then even a rise in take-up rates that is only slightly higher than our prediction could bring about a substantial increase in the forecast market value by 2022.”

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services that is a part of Aon Global Operations, Singapore Branch, a part of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances, as well as commercial lines insurance.

International Health Insurance for Expatriates, Students and Affluent Individuals: A Worldwide Review is a series of reports and market data files about the global market for health insurance and related cover sold to expatriate and student customers, plus affluent residents. Using its proprietary International Health Insurance Market Data Model, Finaccord reports on the value and segmentation of this market in a number of ways:

- by region and major country of origin with data available separately for Africa, the Asia-Pacific region, Australasia, Europe, Latin America, the Middle East and North America as regions of origin, and for Australia, Canada, China, France, Germany, India, the UK and the US as major countries of origin (see note overleaf);

- by destination region and major destination country with data available separately for the same regions and countries;

- by type of customer with a breakdown between individual workers, corporate / other transferees (including diplomats and employees of charities and NGOs), students, retired individuals and other customers (defined as non-employed spouses and children).

Moreover, the market is quantified in terms of total and new business not only in 2018 but also for 2014 and forecast to 2022, thereby illustrating growth trends by region, country and customer type. In addition, data is provided for the same years and segments for the number of international health insurance policies sold and for the total number of eligible consumers (i.e. including expatriates and students who have not taken out this type of insurance). This means that the implied penetration rate for international health insurance can be calculated by region, country and customer type, thereby illustrating the potential for the market to grow further.

Further, for Australia, Canada, China, France, Germany, India, the UK and the US, total policies in force bought locally (and their associated premiums) are split across the same time line between outbound customers, inbound customers and affluent residents.

Finally, the analysis also comprises estimates for the market share of premiums of the leading underwriters of international health insurance both globally and in the eight major countries, and for the latter, the most prominent intermediaries of this type of insurance are identified.

Sample graphic

Worldwide international health insurance gross written premiums, 2014, 2018 and 2022 (forecast)