PRESS RELEASE

Global Automotive Finance and Leasing for Consumers

Download the PDF version of this press release here.

London, 13 May 2015 - Automotive finance is one of the major components of consumer credit and is also one of the major factors behind car sales, since most customers cannot buy a car without some form of loan or lease.

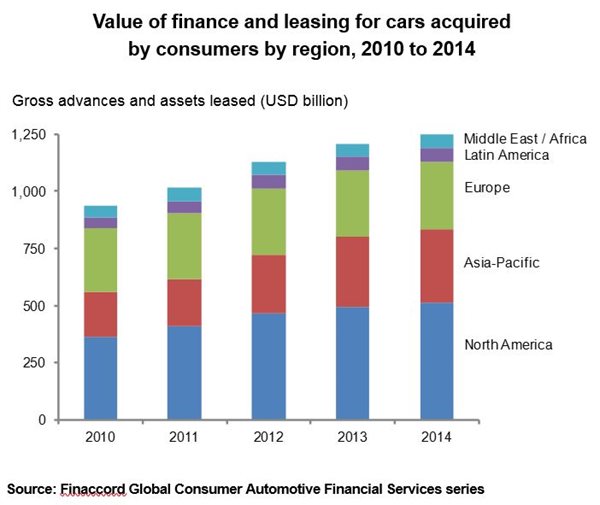

Finaccord estimates that the global market for automotive finance and leasing was worth USD 1.24 trillion in 2014, measured in terms of new loans and leases for consumers buying passenger cars across the world. This market has grown from an estimated USD 932 billion in 2010, meaning that it rose at a compound annual growth rate of 7.5% over this period.

The development of this market geographically reflects deeper trends both in the underlying car market and in consumer lending. North America is the largest single region for automotive finance, with around USD 511 billion of new loans and leases made in Canada and the US for 2014, giving it 41.1% of the global total. With a compound annual growth rate of 8.9% between 2010 and 2014, lending in this region has expanded slightly faster than the global average. The Asia-Pacific region (including Australia) was the second-largest region in 2014 with 25.5% of the global total and has overtaken Europe, with a share of 23.5%. Rapid growth in the Asia-Pacific region compared to weakness in Europe means that a relatively narrow lead in 2014 (USD 317 billion against USD 292 billion) will most probably grow ever-larger in the next few years. Other emerging markets such as Latin America have not performed as well as the Asia-Pacific region; with a value of USD 62 billion, this region made up just 5.0% of the global total in 2014, and grew at a more modest compound annual rate of 6.5% between 2010 and 2014.

“Within the Asia-Pacific region, the outstanding features are the boom in China compared to stagnation in Japan", comments Yapei Zhang, Consultant at Finaccord. "Automotive finance in China rose from an estimated USD 38 billion in 2010 to USD 133 billion in 2014, fuelled by a rapid increase in new and used car sales and by a credit boom, especially in point-of-sale lending. In contrast, automotive finance in Japan stood at USD 62 billion in both of these years. Obviously car ownership in Japan is already very high, but continued growth in the US shows that mature markets can still expand."

Finaccord's research also divided automotive finance between new and used cars, and between finance taken out through car dealerships (i.e. at the point of sale) and finance taken out through all other channels (i.e. direct finance). At a worldwide level, automotive finance for new cars was estimated to be worth USD 703 billion in new business for 2014, ahead of USD 540 billion for used cars. New car finance also grew faster than used car finance between 2010 and 2014 because new car sales to individuals rose faster than used car sales both in the US and in some major emerging markets such as Indonesia, Mexico and Turkey.

Similarly, point-of-sale finance expanded faster than direct finance over this period partly because of its popularity in certain countries in the Asia-Pacific region where direct bank lending remains relatively weak, and partly because of its popularity in the US, especially among sub-prime customers who struggle to get a loan elsewhere. Globally, new point-of-sale loans and leases were estimated at USD 899 billion for 2014, up at a compound annual rate of 9.4% since 2010, while direct finance rose by 3.2% a year on the same measure to reach USD 345 billion for 2014.

"Automotive finance is highly flexible, and takes different forms to adjust to consumer demands around the world. For example, a third of customers in Malaysia use Islamic hire purchase contracts, while many specialist used car dealers in the US offer their own loans to sub-prime customers even though default rates are high, because that's the only way that such customers can afford a car," concludes Ms. Zhang. "On the other hand, better-off customers in mature markets can opt for contracts that enable them to change car every few years, and as many as half of all point-of-sale finance contracts in the UK take this form."

--- END ---

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Finaccord is a market research, publishing and consulting company specialising in financial services. It provides its clients with insight into and information about major issues in financial services in the UK, Europe and globally, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

The countries covered by the global consumer automotive financial services series by region are as follows: Asia-Pacific: Australia, China, India, Indonesia, Japan, Malaysia, Philippines, South Korea, Taiwan, Thailand and Vietnam; Europe: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, UK and Ukraine; North America: Canada and the US; Latin America: Argentina, Brazil, Chile, Colombia, Mexico and Peru; Middle East and Africa: South Africa.

Graphic based on the research series showing the value of new business for consumer automotive finance and leasing from 2010 to 2014 by region. Note that this data covers passenger cars only, and excludes pick-up trucks, other light commercial vehicles and motor cycles.