PRESS RELEASE

Global Coalition Loyalty Programs

Download the PDF version of this press release here.

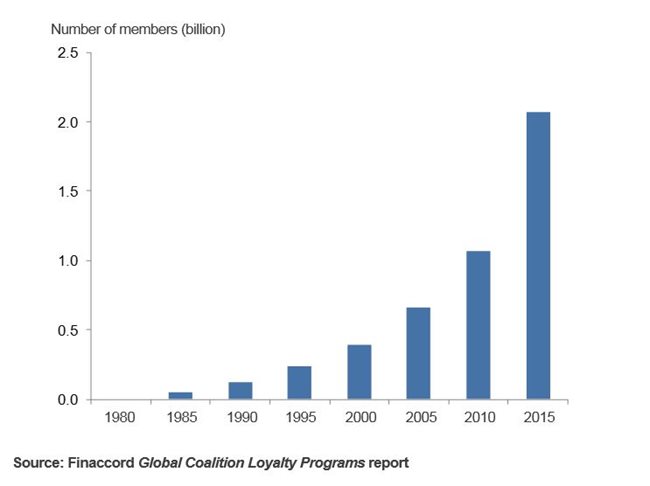

London, 24 August 2015 – Around 2.07 billion consumers worldwide are likely to be members of at least one coalition loyalty program, which is equivalent to approximately 28.4% of the world’s adult population, and this number has almost doubled since 2010 given an estimate of 1.07 billion for that year. Moreover, as at mid-2015, the largest coalition loyalty program in the world by number of members (with around 397 million) was India’s Max Get More program in spite of the fact that it was launched as recently as 2012. These are key findings from an updated and expanded study of coalition loyalty programs around the world – Global Coalition Loyalty Programs – based on analysis of 235 such programs across a wide range of countries.

“Max Get More has developed very rapidly because its owner, Loylty Rewardz Management, operates what it believes to be a unique model whereby it has brought the customers of a number of leading banks in India onto a common platform”, commented Alan Leach, Director of Finaccord. “However, the programs that have achieved the highest rates of penetration among the total adult population (aged over 18) of the country or countries in which they are active are South Korea’s OK Cashbag and Finland’s K-Plussa with both in excess of 85%. In addition, the equivalent percentage for another seven programs is more than 50%.”

Segmented by sector of origin, the approximate distribution of the total figure for all coalition loyalty programs of 2.07 billion members is as follows: airlines – 662.0 million; banking – 500.5 million; hospitality – 343.7 million; retail – 169.9 million; travel excluding airlines – 5.4 million; other specific sectors – 20.6 million; and non-specific origins – 363.1 million. Furthermore, across all 235 programs, the average number of external currency-earning partners per program at the time of the research was around 93 with an equivalent figure for external currency-redemption partners of 73 (noting that program ‘currency’ is usually described as ‘points’ or ‘miles’).

Continued Alan Leach: “This imbalance between currency-earning and currency-redemption partners is partly a consequence of the fact that while many program owners allow members to earn currency across a very wide range of external partners, they sometimes have a preference for narrowing down the number of options for currency redemption so that this is focused mainly on their own commercial proposition.”

Looking ahead, Finaccord believes that the outright number of coalition programs worldwide will continue to grow as an increasing proportion of proprietary loyalty schemes experience declining effectiveness, thereby forcing their sponsors to evaluate the coalition model. Partly as a consequence of this and partly as a result of the organic growth of programs already in existence, the total number of members of coalition loyalty programs worldwide will carry on expanding rapidly.

“The evolving behaviour and needs of program members, especially so-called ‘millennials’, means that loyalty cards will be superseded gradually by mobile device apps that perform multiple functions in addition to currency redemption, and that will be tied to mobile wallet providers”, concluded Alan Leach. “Moreover, coalition programs will increasingly learn how to utilise the data that they build up about their members to develop genuinely personalised offers for them, including ones based on their location at any given point in time.”

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services. It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

Global Coalition Loyalty Programs is a report about the growth in the number and membership of coalition loyalty programs that has occurred globally in recent years and the affinity and partnership marketing opportunities that they offer to a huge range of organisations serving consumers as their customers, members or supporters. Coalition loyalty programs, including certain airline frequent flyer programs and hotel group loyalty schemes that can be defined as coalition loyalty programs as a result of their currency-earning characteristics, are potentially attractive partners for consumer-facing organisations for several reasons.

These include: that they tend to have a high number of members relative to other affinity groups in any given country; that they are generally growing more quickly than other affinity groups; that their membership is often made up of consumers with specific characteristics (e.g. individuals with above average wealth in the case of hotel group schemes); that they incentivise consumers to buy products or services on a regular basis by awarding them points or miles in return; and that they are normally underpinned by sophisticated technology which facilitates advanced customer relationship management and marketing activity.

Sample graphic

Estimated growth in total number of members of coalition loyalty programs worldwide segmented by sector of origin of program, 1981 to 2015