PRESS RELEASE

Global Energy and Power Insurance: A Worldwide Review

Download the PDF version of this press release here.

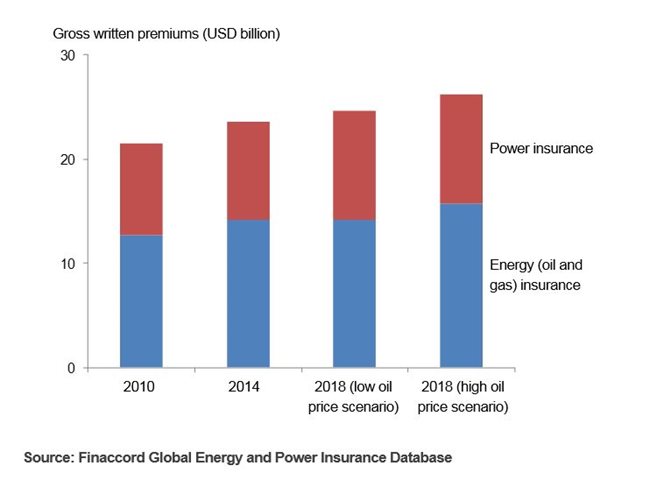

London, 23 September 2015 – According to new research published by Finaccord, energy and power insurance premiums worldwide, including business handled by captive and mutual insurers, amounted to around USD 23.56 billion in 2014 having increased from around USD 21.48 billion in 2010, which was equivalent to a compound annual growth rate in nominal terms of 2.3%. In 2014, this total market segmented between around USD 14.16 billion from energy insurance premiums and around USD 9.40 billion from power insurance premiums, with the US by far the largest market at around USD 8.38 billion followed by Canada at USD 1.77 billion and China and USD 1.45 billion.

With regards to energy insurance premiums, in particular, these broke down between around USD 7.15 billion from upstream insurance, around USD 2.17 billion from midstream insurance and around USD 4.84 billion from downstream insurance. Commented Christian von Celsing, Consultant at Finaccord: “At the global level, upstream energy insurance premiums have been growing at twice the rate of midstream premiums while downstream premiums actually declined between 2010 and 2014. The more rapid increase in the value of the upstream segment can be attributed to rising exploration and production worldwide. On the other hand, it is generally the case that insurance pricing for downstream assets has been subject to the most pressure.”

As for power insurance premiums, these broke down in 2014 between around USD 7.28 billion from conventional power insurance and around USD 2.13 billion from renewable and other power insurance, and a key global trend has been the rapid growth of renewable and other power insurance premiums given that these had a worldwide value of around USD 1.55 billion in 2010. “Premiums deriving from insurance for solar and wind power have been rising especially rapidly”, continued Christian von Celsing. “This can be expected to continue in future albeit the policies of national governments in this field are often inconsistent or uncertain.”

Looking ahead to 2018, Finaccord forecasts that energy and power insurance premiums worldwide will increase to a value of around USD 24.59 billion under a low oil price scenario (segmenting between around USD 14.14 billion in energy insurance premiums and around USD 10.45 billion in power insurance premiums) and to around USD 26.15 billion in the event of a high oil price scenario (segmenting between around USD 15.70 billion in energy insurance premiums and the same value for power insurance premiums as in the low oil price scenario). The difference here is attributable mainly to the upstream energy (oil and gas) segment, which fluctuates between representing 28% and 32% of overall energy and power insurance premiums in the low and high oil price scenarios, respectively.

Concluded Christian von Celsing: “While the future price of oil has little impact on the future value of power insurance, it would influence the outlook for energy insurance, especially upstream insurance. Furthermore, while far from an exhaustive list, other key trends impacting the outlook for energy and power insurance worldwide include on one hand the likely or possible growth of hydraulic fracturing (fracking), deepwater drilling, Arctic development, solar power and wind power, all of which are conducive to growth and innovation, and on the other, persistent underwriting over-capacity, which depresses premiums, especially in mature markets.”

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services. It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances albeit with increasing coverage of commercial non-life insurance markets, including energy and power insurance.

Finaccord’s research series about global energy and power insurance is composed of an overview study covering all ten territories – Global Energy and Power Insurance: A Worldwide Review – plus ten individual territory-specific reports (which are sub-sets of the overview) and is about the current and future outlook for the insurance of risks associated with the fast-evolving energy (oil and gas) and power sectors worldwide. Territories in scope are Brazil, Canada, China, France, the GCC countries (i.e. Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE), Germany, Japan, Nigeria, the UK and the US, with the rest of the world expressed as a residual balance in the overview report for both energy and power insurance.

Note that for its forecast for the value of the energy and power insurance market in 2018, Finaccord’s low oil price scenario assumes that the West Texas Intermediate price averages USD 50 per barrel in 2015, and rises steadily to USD 75 per barrel in 2018, while the high oil price scenario assumes a sharp rise to USD 125 per barrel in 2018.

Sample graphic

Worldwide energy and power insurance gross written premiums, 2010, 2014 and 2018 (forecast according to low and high oil price scenarios)