PRESS RELEASE

Small Business Segments: Marketing Business Insurance to Major Professions and Trades in the UK

Download the PDF version of this press release here.

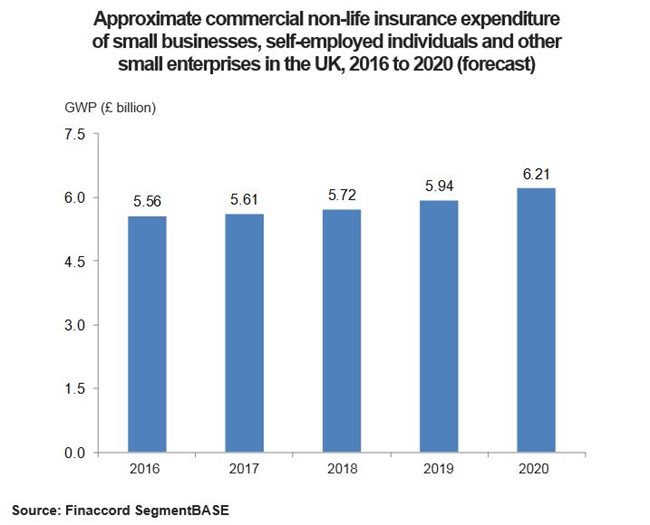

London, 6 September 2017 – The total market for small business insurance (commercial non-life) in the UK is forecast to grow at a compound annual rate of 2.8 percent up to 2020 to reach around £6.21 billion in that year, according to Finaccord, the market research, publishing and consulting company specialising in financial services. This growth will be due to an increase in the number of insured enterprises, as well as a moderate rise in average premiums.

Finaccord’s new report, Small Business Segments: Marketing Business Insurance to Major Professions and Trades in the UK, confirms that expenditure on commercial non-life insurance by small businesses is set to total around £5.61 billion in 2017. This market has grown at a compound annual rate of 1.9 percent since 2013 when it was valued at £5.20 billion (not adjusting for inflation). The report covers businesses, self-employed individuals and other enterprises (e.g. charities) with an annual turnover of up to £5 million.

David Parry, Managing Consultant at Finaccord commented:

“The market for commercial insurance acquired by small enterprises and self-employed individuals in the UK is not a single, homogeneous sector but rather a series of niches that vary radically by size and growth. For example, there are now more than 2 million buy-to-let landlords in the UK, which makes this the largest out of 105 distinct segments analysed by Finaccord; they are followed by around 500,000 community and voluntary organisations, whose insurance needs are completely different".

Spending patterns reflect evolving business landscape in the UK

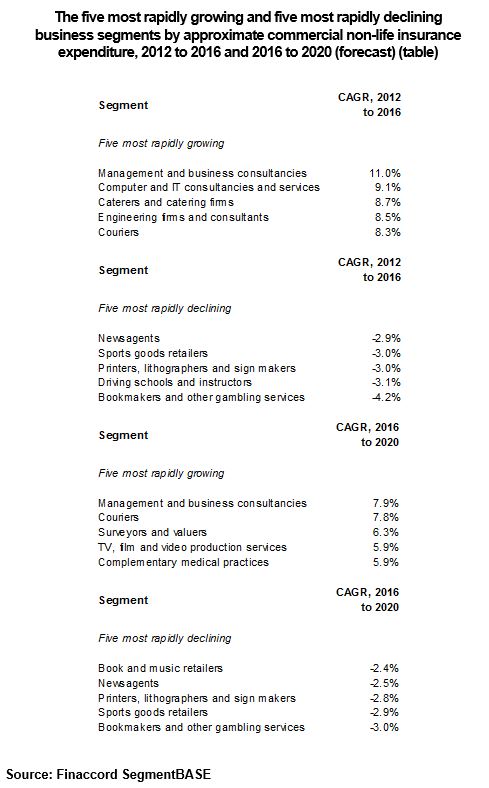

Management and business consultancies have seen the greatest increase in expenditure on insurance with a compound annual growth rate of 11 percent from 2012 to 2016. Looking ahead, this segment is again expected to register the highest increase in insurance expenditure with a forecast compound annual growth of 7.9 percent between 2016 and 2020. This continuing rise in expenditure reflects rapid expansion in the underlying number of small management and business consultancies driven in part by experienced individuals leaving large companies to start their own enterprises.

Other segments recording particularly rapid growth in expenditure between 2012 and 2016 include computer and IT consultancies and services (9.1 percent), caterers and catering firms (8.7 percent), engineering firms and consultants (8.5 percent) and couriers (8.3 percent). Looking ahead, and in addition to management and business consultancies, Finaccord anticipates the highest increases for couriers (7.8 percent), surveyors and valuers (6.3 percent), TV, film and video production services (5.9 percent), and complementary medical practices (also 5.9 percent). Ultimately, these trends are determined mainly by growth in the underlying number of enterprises in each segment.

In contrast, the falls in expenditure recorded since 2012, plus those that are forecast up to 2020, reflect the long-term reduction in the number of small enterprises in certain sectors. Looking at the trend in insurance expenditure between 2016 and 2020, Finaccord predicts that the most rapid decline will occur in the case of bookmakers and other gambling services (-3.0 percent), for while online gambling has experienced a boom, this has not been to the benefit of small enterprises offering gambling services. In addition, the outlook for insurance expenditure is also negative for sports goods retailers (-2.9 percent), printers, lithographers and sign makers (-2.8 percent), newsagents (-2.5 percent), and book and music retailers (-2.4%).

Regional variations are also apparent

On top of this, there are important regional variations. For example, while it is no surprise that insurance expenditure by small enterprises grew most quickly in London between 2012 and 2016, the East Midlands and West Midlands held second place jointly. Overall, the two largest regional markets are those of London and the South East, and looking ahead to 2020, both of these regions are expected to outgrow the national average.

David Parry concluded:

“Insurance providers that position themselves in specific professional and trade segments stand to grow more quickly than those with a less targeted offering. While the value of the commercial insurance market has grown little in recent years, there are several interesting niches which have achieved high growth rates in insurance expenditure and that are forecast to expand further as many enterprises remain under-insured. Some of these niches are served by a relatively limited number of brokers and underwriters with products specifically tailored to their needs, and this represents an alternative strategy to the commoditised approach often applied to small and micro enterprises”.

--- ENDS ---

Media contact: Amandas Ong, +44 (0) 207 086 1336, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services. is part of Aon Inpoint, Aon Risk Solutions, a business unit of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

Finaccord’s Small Business Segments: Marketing Business Insurance to Major Professions and Trades in the UK casts new perspectives on the market for insurance acquired by small businesses and self-employed individuals in the UK. With a focus on enterprises with an annual turnover of up to £5 million, the research sizes the market both in terms of the actual number of insurable enterprises in each of 105 major professional and trade segments and the value of their business insurance expenditure each year. The complete list of segments analysed can be viewed here. In addition, a similar analysis is provided across 12 regions listed here.