PRESS RELEASE

Global Bancassurance: creditor, household and risk life insurance are most often available from banks

Download the PDF version of this press release here.

- Banks are increasing the range of insurance product types that they market to their customers;

- these include policies for small business customers as well as individual consumers;

- creditor (payment protection) insurance remains an important bancassurance product in most countries.

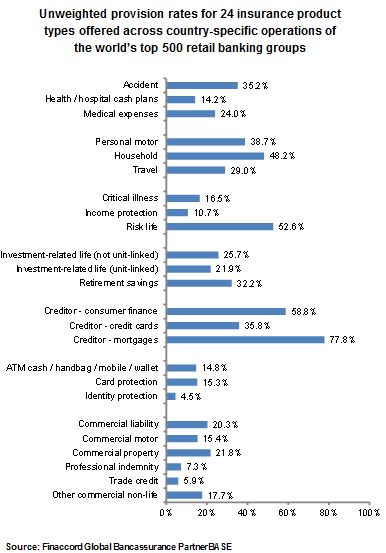

London, 20 February 2018 – The continuing importance to banks of loan-related insurance in many countries has been highlighted by new global research from Finaccord about the different types of insurance sold by banks. Based on an investigation into the insurance product portfolios of over 1,500 consumer banks and other lending institutions belonging to the world’s top 500 retail banking groups across over 100 countries, the report shows that mortgage-related creditor insurance is the policy type most likely to be on offer from them, followed by creditor insurance related to consumer finance, risk life insurance, and household insurance. At the time of the research, which was mainly carried out in 2017, 77.8% of mortgage lenders were promoting at least one form of mortgage-related creditor insurance, with non-mortgage loan protection policies on offer from 58.8% of the relevant institutions (i.e. those providing consumer finance), and with risk life and household insurance from a respective 52.6% and 48.2% of all banks researched.

"In many countries around the world, creditor insurance, also known as payment protection insurance, remains an important bancassurance product”, comments Claire Michaud, a Consultant at Finaccord. "While regulatory intervention has put an end to most forms of creditor insurance in the UK, the market is believed globally to be worth around USD 90 billion in total premiums, most of which is distributed through the banks and other lenders granting the underlying credit. Risk life and household insurance also represent obvious cross-selling opportunities among both mortgage borrowers and other retail customers for most banks."

At the other end of the spectrum, of the policy types considered, identity protection and trade credit insurance are those least likely to be available from the banks researched given that they were available from only 4.5% and 5.9%, respectively. However, other forms of commercial non-life insurance, such as general-purpose liability and property policies for small business customers, were available from over 20% of banks researched, and penetration rates were higher still for investment-related life insurance plus various types of non-life cover such as accident, personal motor and travel cover (as depicted in the chart on the final page of this press release).

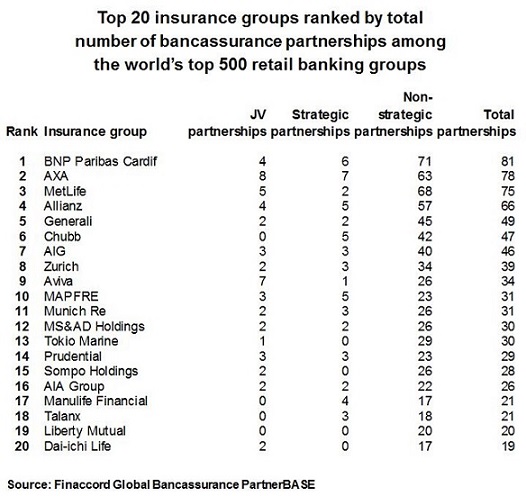

With regards to the insurers providing these types of insurance to banks, BNP Paribas Cardif holds the most partnerships for creditor insurance, MetLife is strong in both accident and health insurance and protection-related life cover, Allianz and AXA are leaders for most forms of non-life insurance, and Prudential is a prominent partner for banks for investment-related life insurance and retirement savings products. "Product innovation is a key aspect of bancassurance”, concludes Claire Michaud. "However, there remains plenty of scope for banks to broaden the array of insurance products that they offer, especially in geographies such as Africa and the Middle East, plus some countries in the Asia-Pacific region, where bancassurance remains a less developed concept."

--- ENDS ---

Media contact: Amandas Ong, [email protected]

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services that is part of Aon Inpoint, Aon Risk Solutions, a business unit of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

Global Bancassurance: Product and Partnership Strategies of the World’s Top 500 Retail Banking Groups is the master report and associated PartnerBASE™ dataset in Finaccord’s comprehensive series of studies about bancassurance worldwide. In addition to this master publication, plus another that focuses on the world’s top 150 retail banking groups, a variety of regional and global product-specific studies about bancassurance are also available. The four regional reports cover Africa and the Middle East, the Americas, the Asia-Pacific region and Australasia, and Europe. Meanwhile, the six global product-specific publications provide worldwide analyses of bancassurance initiatives for the following insurance product categories: accident and health insurance; commercial non-life insurance; investment-related life insurance and retirement savings; motor, household and travel insurance; personal and identity protection insurance; and protection-related life insurance.