PRESS RELEASE

Global Bancassurance: insurers place an increasing emphasis on creating long-term bancassurance partnerships

Download the PDF version of this press release here.

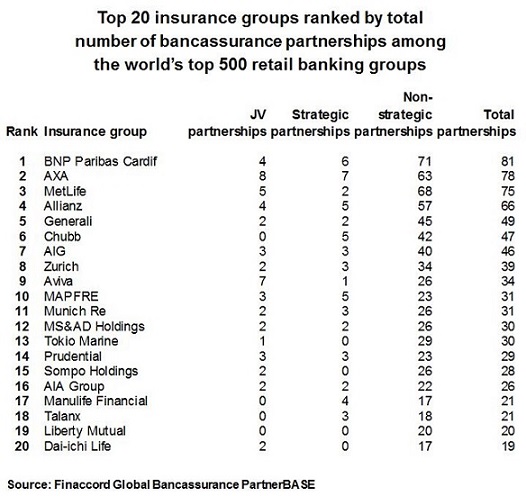

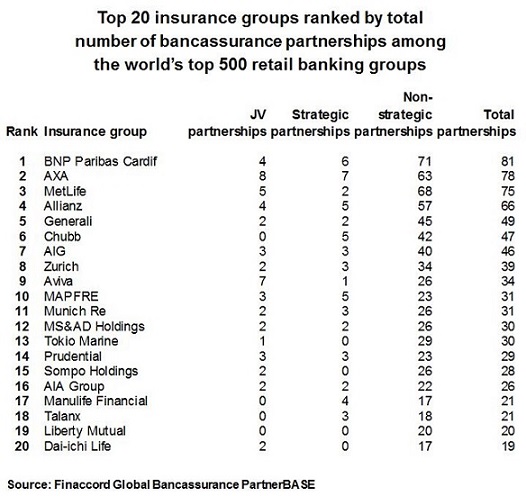

- Measured globally, BNP Paribas Cardif, AXA and MetLife hold the most bancassurance relationships of any type;

- these insurers also rank highly in terms of their number of joint ventures and strategic bancassurance agreements;

- opportunities in bancassurance are increasing as banks expand their product offering and make use of alternative sales channels, including digital distribution.

London, 13 February 2018 – Insurance companies that want to expand internationally face substantial distribution challenges: how do they establish their brand and how do they reach new customers? One way for them to try to solve these problems is through creating sales partnerships with leading banks, which gives them access to a new customer base using the bank’s own brand. According to new research about global bancassurance strategies published by Finaccord, BNP Paribas Cardif is the insurance group holding the most bancassurance partnerships among the world’s 500 largest retail banking groups, followed by AXA and MetLife.

Based on an investigation into the consumer banking operations of the top 500 retail banking groups worldwide (spanning over 100 countries), Finaccord’s research established that BNP Paribas Cardif was being utilised as an insurance partner for at least one bancassurance product by a total of 81 of the 500 banking groups. The France-based insurance group was followed by AXA with a total of 78 partnerships, and MetLife with a total of 75 agreements. Overall, among the 20 most prominent insurance groups in terms of their number of relationships with the top 500 banking groups, ten originated from Europe, five from North America and five from the Asia-Pacific region.

"Competition among international insurance groups for bancassurance partnerships has been intense in recent years”, comments Stefan Wagner, a Consultant at Finaccord. "This is a consequence of the high or rising importance of bancassurance as a distribution channel in a number of insurance markets including China, Indonesia and Thailand in the Asia-Pacific region, Poland and Spain in Europe, and Brazil and Mexico in Latin America. In addition, many banks have expanded substantially their offering not only into new product areas but also into alternative sales channels, including digital distribution, which has created more partnership opportunities for insurers.”

Finaccord's research also classified insurance groups' partnerships with the 500 banking groups according to whether they were set up either as joint ventures, as strategic, long-term relationships, or as less substantial, ad hoc distribution partnerships. With regards to joint ventures and strategic agreements among the 500 banking groups, AXA is the insurance group with the most such arrangements at 15 (breaking down between eight joint ventures and seven strategic relationships). It is followed by BNP Paribas Cardif with ten, Allianz with nine, Aviva and MAPFRE with eight each, and MetLife with seven.

"While the total number of partnerships is certainly a helpful measure to identify key insurance groups in the global bancassurance market, it is also important to look at joint venture and strategic partnerships as these commonly have a long-term focus and often generate substantially more revenue than looser distribution agreements”, concludes Stefan Wagner. "As such, international insurance groups are increasingly seeking these types of deal. For example, major agreements established during 2017 included those of Allianz with Standard Chartered and of Chubb with DBS, both for non-life insurance and spanning multiple countries in the Asia-Pacific region."

--- ENDS ---

Media contact: Amandas Ong, +44 (0) 207 086 1336,

Notes to editors:

Finaccord is a market research, publishing and consulting company specialising in financial services. is part of Aon Inpoint, Aon Risk Solutions, a business unit of Aon plc (NYSE: AON). It provides its clients with insight into and information about major issues in financial services around the world, with a particular focus on marketing and distribution topics such as affinity marketing, bancassurance and strategic alliances.

Global Bancassurance: Product and Partnership Strategies of the World’s Top 500 Retail Banking Groups is the master report and associated PartnerBASE™ dataset in Finaccord’s comprehensive series of studies about bancassurance worldwide. In addition to this master publication, plus another that focuses on the world’s top 150 retail banking groups, a variety of regional and global product-specific studies about bancassurance are also available. The four regional reports cover Africa and the Middle East, the Americas, the Asia-Pacific region and Australasia, and Europe. Meanwhile, the six global product-specific publications provide worldwide analyses of bancassurance initiatives for the following insurance product categories: accident and health insurance; commercial non-life insurance; investment-related life insurance and retirement savings; motor, household and travel insurance; personal and identity protection insurance; and protection-related life insurance.